Key Takeaways:

- Investing in stocks means buying a small piece of ownership in a company. As a shareholder, you can profit from the company’s growth and success.

- Stocks can be volatile and risky, so it’s important to diversify your portfolio by investing in multiple companies and industries.

- Before investing, it’s essential to do your research on the company, including its financials, industry trends, and management team.

- It’s important to have a long-term mindset when investing in stocks. Trying to time the market or chase short-term gains can lead to losses.

- Consider investing in index funds or ETFs, which provide exposure to a broad range of stocks and can be a good choice for beginners.

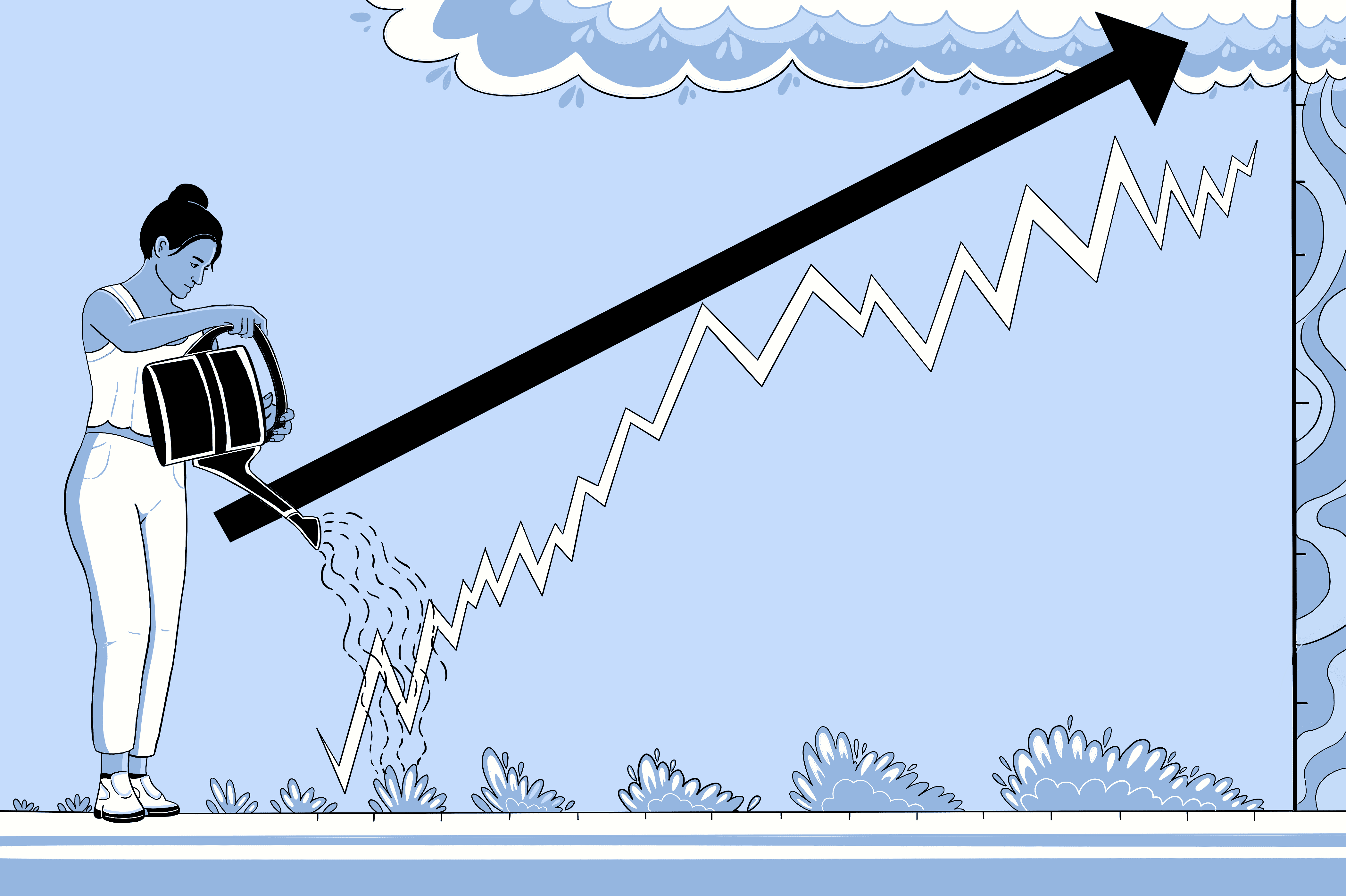

Investing in stocks is a great way to grow your money over time, but it can also seem intimidating and complicated, especially for beginners. In simple terms, buying stocks means buying a small piece of ownership in a company. As the company grows and becomes more profitable, the value of your shares can increase, allowing you to make money. However, it’s important to remember that investing in stocks comes with risks, and it’s essential to do your research and make informed decisions. With patience, discipline, and a long-term mindset, investing in stocks can be a rewarding and exciting journey towards financial growth.

Tips for beginners to invest in stocks:

If you’re new to investing in stocks, it can be overwhelming to figure out where to start. Here are some tips to help you get started:

- Do your research: Before investing in any company, it’s important to , and understand its financials, industry trends, and management team. Look for companies that have a strong track record of growth and profitability.

- Diversify your portfolio: Don’t put all your eggs in one basket. Invest in multiple companies and industries to spread your risk.

- Start small: You don’t need a lot of money to start investing in stocks. Begin with a small amount and gradually increase your investments over time.

- Use index funds or ETFs: If you’re not sure which companies to invest in, consider buying a low-cost index fund or ETF that tracks a broad range of stocks.

- Have a long-term mindset: Don’t get too caught up in short-term market fluctuations. Investing in stocks is a long-term strategy for building wealth.

- Keep emotions in check: Don’t let fear or greed drive your investment decisions. Stick to your strategy and avoid making emotional decisions based on market volatility.

- Monitor your investments: Keep an eye on your investments and regularly review your portfolio to make sure it aligns with your goals and risk tolerance.

Remember, investing in stocks can be a great way to build wealth over time, but it’s important to approach it with patience and discipline. With the right mindset and a solid strategy, you can potentially benefit from the growth of the stock market over the long term.

A Small Example to Understand Investing for Beginners

Let’s say you’ve always loved using social media and you believe that a certain social media company has a great product and is growing fast. You might decide to invest in that company’s stock by buying a few shares.

If the company does well, its stock price may increase over time, and as a shareholder, you could benefit from that growth. For example, let’s say you bought 10 shares of the social media company at $50 per share. If the stock price increases to $75 per share, your investment would be worth $750, which is a 50% increase in value.

However, if the company doesn’t perform well, the stock price may go down, and you could lose money. That’s why it’s important to research the company before investing and to diversify your portfolio by investing in multiple companies and industries.

It’s also important to have a long-term mindset when investing in stocks. Trying to time the market or chase short-term gains can be risky, and it’s better to think about investing as a way to build wealth over time. By starting small and gradually increasing your investments as you gain more experience, you can learn the ins and outs of the stock market and potentially benefit from its growth over the long term.

Investing in stocks can be a great way to grow your wealth over time, but it also comes with risks. Here are some pros and cons of investing in stocks for beginners:

Pros:

- Potential for high returns: Stocks have historically provided higher returns than other investments like bonds or savings accounts.

- Ownership in a company: As a shareholder, you can benefit from a company’s growth and success.

- Diversification: By investing in stocks of multiple companies and industries, you can spread your risk and potentially increase your terms.

- Liquidity: Stocks are easy to buy and sell, making them a relatively liquid investment.

Cons:

- Risk: Stocks can be volatile and risky, and the value of your investments can go down as well as up.

- No guarantees: There are no guarantees that a company will perform well or that you will make money from your investments.

- Time and effort: Researching companies and managing your investments can be time-consuming and require effort.

- Fees and taxes: You may need to pay fees to buy and sell stocks, and you’ll also need to pay taxes on any gains you make.

Conclusion:

Investing in stocks can seem intimidating for beginners, but it doesn’t have to be. By doing research, diversifying your portfolio, starting small, being patient, and avoiding emotional decision-making, you can set yourself up for success. Remember that investing in stocks is a long-term game, so focus on building a solid strategy and sticking to it. With time and experience, you can grow your wealth and achieve your financial goals through the stock market.

Disclaimer: Please note that the information provided in this article is for informational purposes only and should not be construed as investment advice. Investing in financial markets involves risk, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. The author and the publisher of this article do not accept any liability for any loss or damage caused by reliance on the information provided herein.

Recent Posts

- Larger Mouth area 12 months 8: Nick Kroll and online casino prepaid deposit you will Creators Interview

- Confusione Gratifica Senza Base Successivo 10,000 EUR Gratifica intense casino accedi Gratis

- 50 Free Spins No deposit Deposit Expected Finest Gambling establishment Web sites inside 2025

- Slot VLT A scrocco royal vincit casino accesso affiliato Online: Tutte le Demo dei Giochi ancora Famosi

- Larger Split slot: Fool around with online roulette real money $100 Free Bonus!

Recent Comments

Why should you choose Banking and Financial services fund?

Difference Between Mutual Funds and Exchange Traded Funds: A Closer Look

When the world order responds to cryptocurrency: CBDC

India’s CBDC Project: A New Direction Towards Digital Currency

How to Earn Passive Income Using a Staking Pool?